Why make a legacy gift?

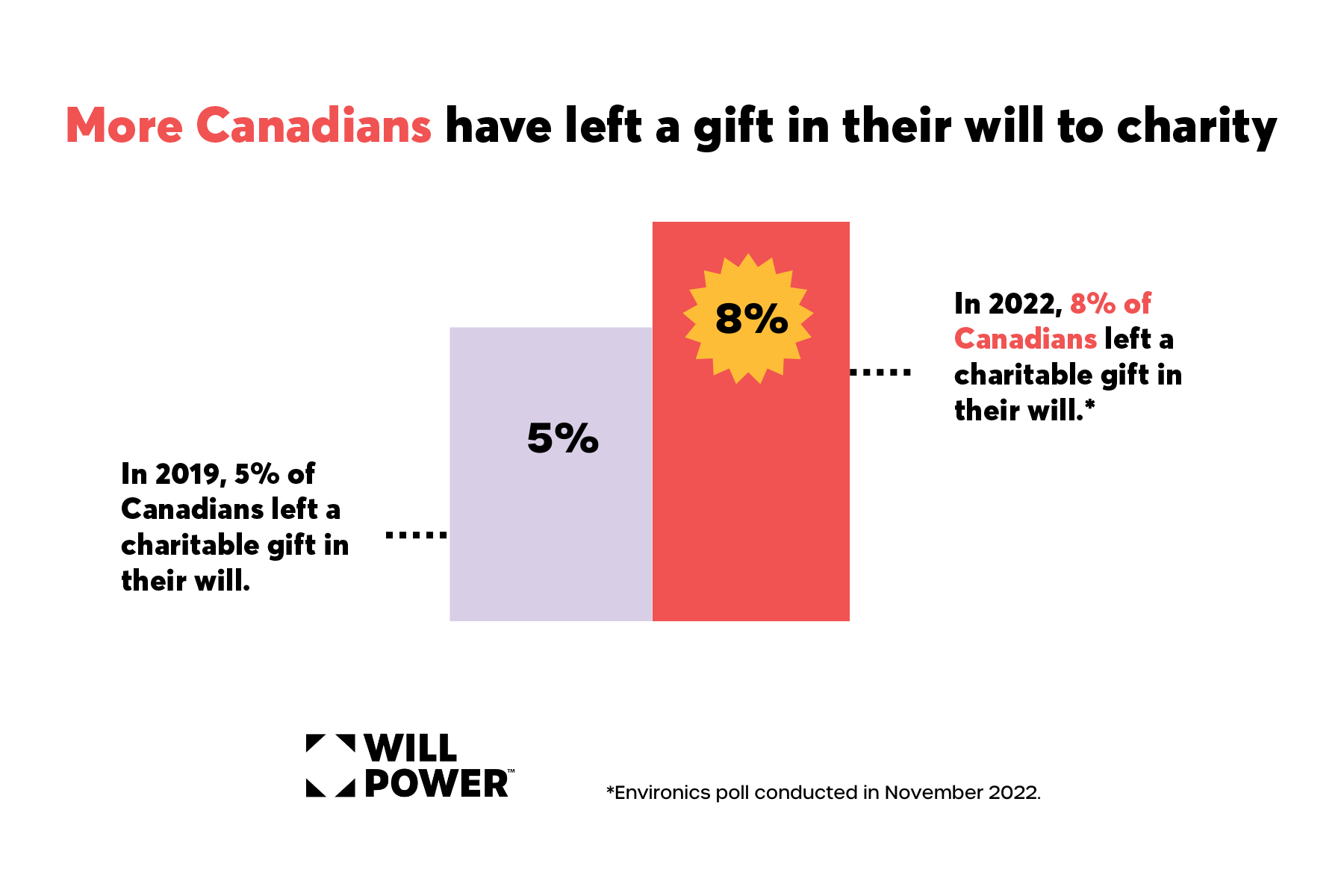

Did you know that you can leave money in your will to a registered charity like the CHUM Foundation? You’ll probably hear more and more talk about this in years to come, given that a study by Will Power showed a significant rise (from 5% to 8%) in the number of Canadians making charitable gifts in their wills.

In other words, 1.2 million people have chosen to leave a charitable gift in their will, adding up to around $37 billion in legacy gifts.

Now imagine what those $37 billion could do for the causes that are near and dear to your heart. How many diseases could we beat, and how could we shape the health of generations to come?

Imagine the impact we could have for the patients.

Why are legacy gifts on the rise?

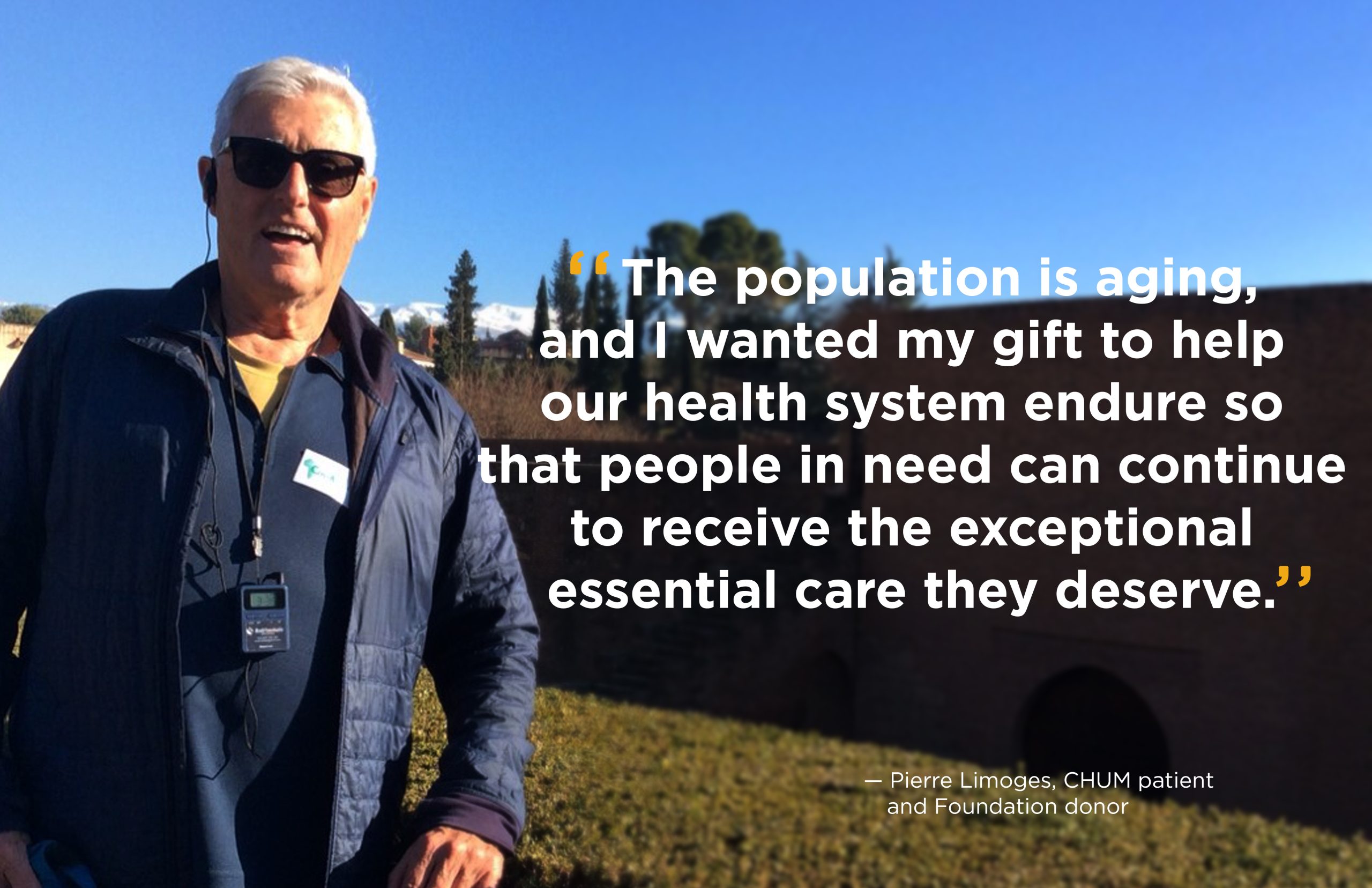

One of the major reasons is that today’s economy has people tightening their belts more. Fortunately, when you leave a gift in your will, you can make a major impact, while still having enough to live on and providing for your loved ones. Just 1% of your estate can make a big difference in your community.

Legacy gifts are also becoming more and more popular as a way to address the world’s pressing, ever-growing needs in the face of current economic conditions. While inflation and the cost of living have put pressure on incomes, people want to help their neighbours more than ever before. All of that makes legacy gifts an accessible way to help change the world.

There’s also a demographic reason. We’re on the verge of the largest wealth transfer in Canada’s history: approximately a trillion dollars will be passed down over the next 10 years. Many donors are realizing that they have enough money to support both their family AND their favourite charitable cause in their will.

And, lastly, people are increasingly financially savvy. They understand how to juggle their will, RRSP and other assets so they can give more strategically.

The benefits of leaving a gift in your will

There are plenty of benefits to making a legacy gift:

Give more than you could in your lifetime

The value of your estate is equal to the sum of your assets, pension or registered funds, publicly traded securities, cash savings and life insurance. Even after all debts are paid off, this often adds up.

For reference, the average estate’s assets totalled $981,816 in Canada in 2023. Setting aside 1% of that for a charity means a gift of nearly $10,000. Now that could have quite the impact on CHUM patients!

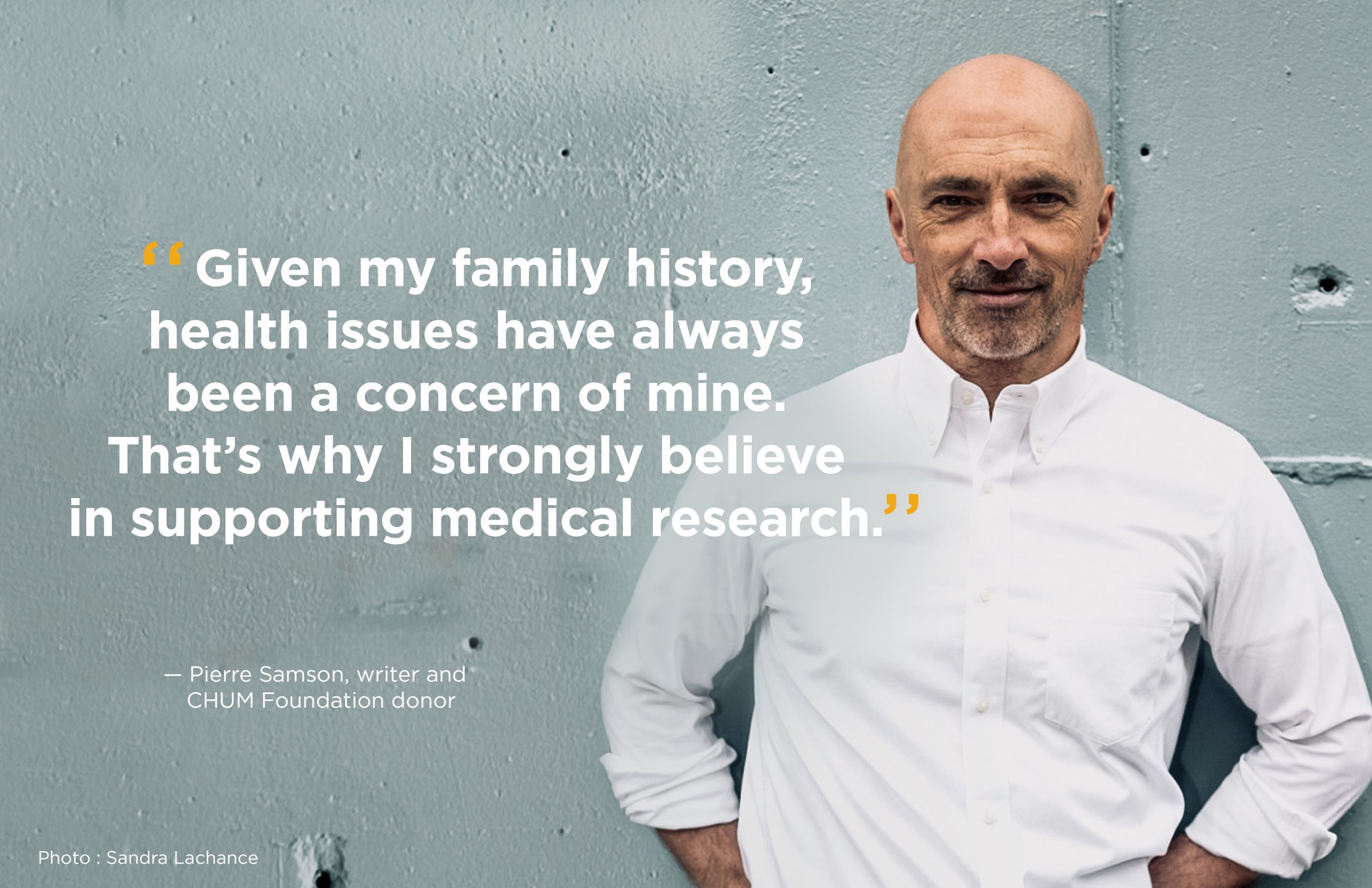

Leave your mark

Like many of us, you may also be looking for a way to leave your mark—a way to make a last gesture of commitment to a cause that’s dear to your heart.

Planning a charitable gift in your will is a way to make a real difference for generations to come; it’s also a way to leave a legacy of your values and, often, inspire your loved ones. A legacy gift is an opportunity to carry on your involvement with the CHUM in perpetuity and leave a lasting impact on your community, all while staying within your means.

A lighter tax burden on your estate

Taxes may not be the first thing you think of when it comes time to give. But the federal government offers generous financial incentives for donors: when you make a gift, you get a tax credit that can significantly reduce the amount of taxes due.

Your heirs will likely be deeply appreciative of that tax credit after you pass, because they may well be shouldering a significant tax burden in your name. There are even different ways to structure your gift so you can give strategically and reduce your taxes as much as possible.

Want to learn more?

Talk to our planned giving team about the options available to you. The conversation is completely confidential, with no commitment needed.